An excerpt of zero sums from the first video series lecture by Mr. Steidlmayer and how they work in trading.

Zero Sums is when we have one person long and one person short and no other open interest. So as the market moves higher or lower, one is going to be right and one is going to be wrong.

Zero Sums Video Transcript:

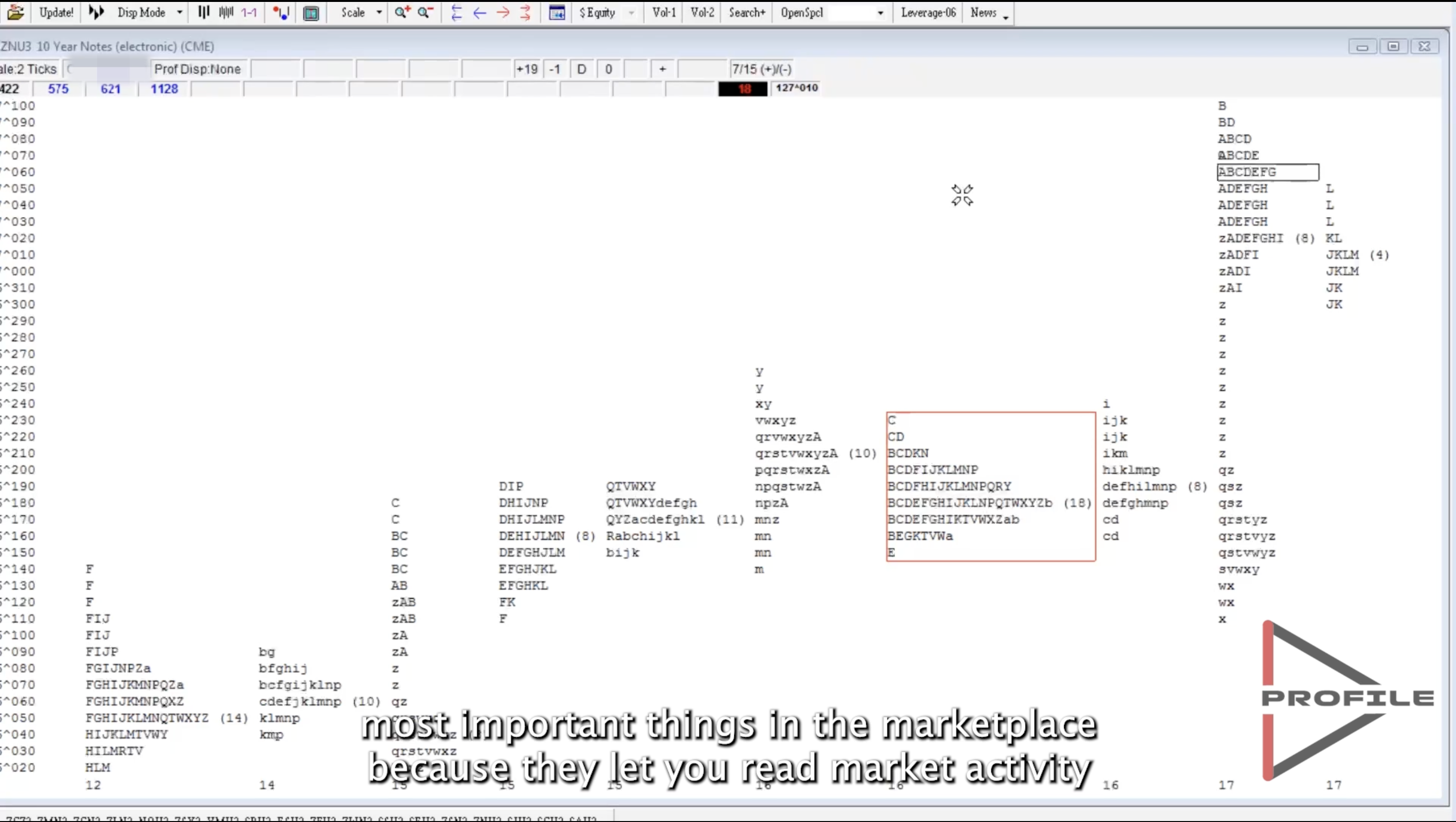

One of the functions of the Board of Trade was to take the zero sums. Now sero sums are probably the most important thing.Zero sums are the most important things in the market place because they let you read market activity. And they give you an example of what we call non price control versus price control. So we will take a look at the people who are trading beans off the floor and they're buying the 78 and put a stop at 65. And they're either going to get stopped out or the market is going to go higher and there was no time associated with the market, no zero sum. It was a price to price trade. In those days price of time were equal and so therefore, they weren't making a mistake doing that. But if we want to have a better edge, I as a local trader would look at the market at a time when the efficiency wasn't really fully in place yet. So when the market opened two lower and then went immediately higher, that was a zero sums reading. That means the people who basically sold that to me two lower have no chance of getting it back. And the idea, if I'm right, the market's going to move away from it. That's going to be the extreme of the market and if the extreme of the market it's not going to take it out. I have all day to play with my trade. On the same token, if I buy it two lower and half hour later the market is still trading there. I don't have zero sum or natural read on my side because the market's accepting the price. Once it accepts the price. A fair price in the market, 50/50 it can go either way. So what we're going to do is explore zero sums and zero sums is where we have one person long, one person short and no other open interest. So as the market moves higher or lower, one is going to be right and one is going to be wrong. And that's what they call zero sums. That is very detrimental for capital because the idea if I sell it and you buy it, basically what we're lookg at is I got to get in from you and you don't want to sell, so I have to go up a dollar a bushel to get the thing to come in. So zero sums are very, very bad for capital formation in the market. And it basically extracts capital from the market and that's what's going on now. So we have less trade this year than last year, less than a year before because zero sums are eating up the capital. We're not able to expand the capital base because that is an exononmic force that reduces capital. So the first thing we have to do in trading is that you have to make sure your capital is safe.